Asset Management

Investment Philosophy

Our goal is to provide clients with a high-quality investment experience. We customize each portfolio by implementing disciplined, fundamentals-based thinking to construct active investment portfolios that add value across an entire market cycle.

What sets us apart?

- We are service oriented…..not commission based

- We utilize true open architecture….no proprietary “products” are used

- Consideration of investment costs at all levels is a top priority

- Investment strategies focus on diversified portfolios that achieve appropriate risk/reward objectives for a given time horizon

- Strategic tax management is used to minimize taxes payable

- All strategies are highly liquid….No lock-up periods

- Entire investment team is local and readily accessible

The Client Experience

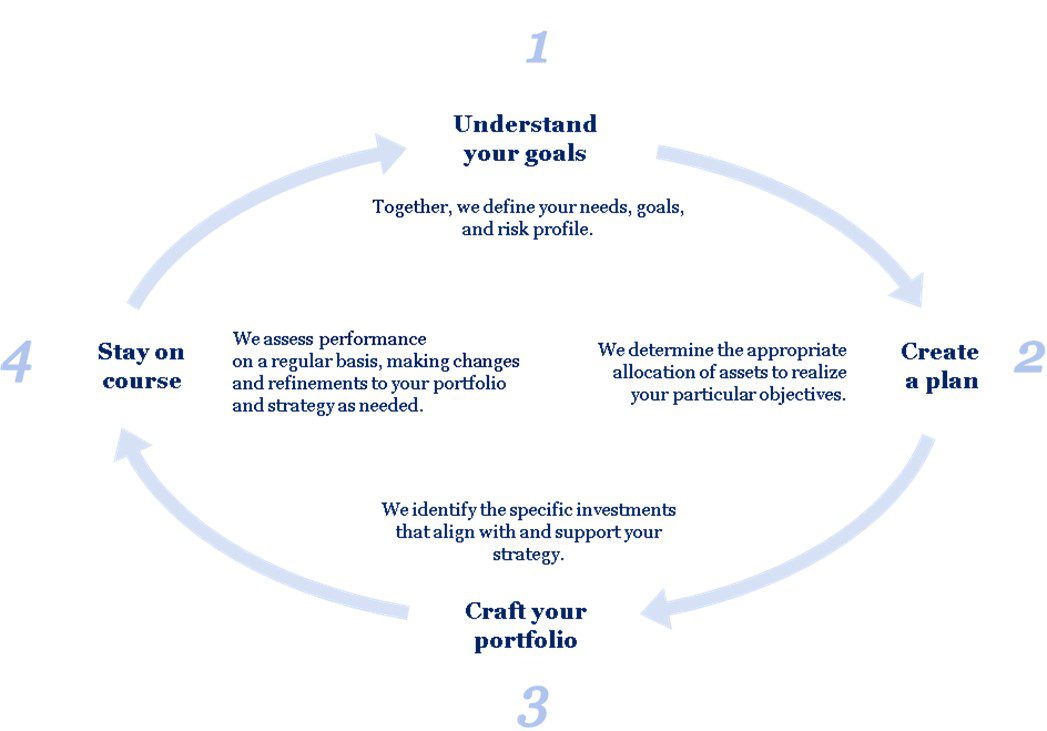

We believe in a collaborative relationship with our clients; we take the time to educate all clients on our rationale for decisions within their portfolios and we encourage frequent communication to ensure the investment strategy employed aligns with their goals.

- Rigorous fund research, monitoring, and management

- Fee-only asset management free of commission charges

- Unique Asset Administration

- Customized investment strategies that align with the client’s long-term goals